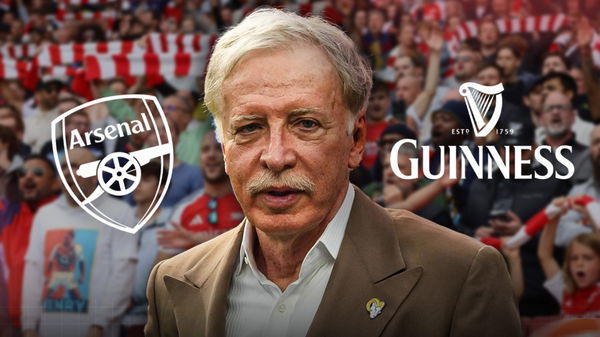

Starting this season, Arsenal fans will see more than just pints when they think of Guinness. The iconic stout brand has joined the Gunners as their official global beer partner—with its logo pouring into Emirates Stadium signage, digital campaigns, and even non-alcoholic game-day rituals. But this isn’t just another badge-on-the-wall deal.

Watch What’s Trending Now!

This multi-year global deal is a smart move into lifestyle-led sponsorship. While official financial terms were not disclosed, industry sources estimated the deal at over £4 million per year ( $5.3 million) for the UK and Ireland sponsorship rights. However, it also has its eyes on Africa and Asia. Even Guinness 0.0, the non-alcoholic variant, plays a role. But how long will this Guinness-Arsenal story unfold?

ADVERTISEMENT

Article continues below this ad

The Arsenal-Guinness partnership breakdown

Markets Targeted: UK and Ireland, with expansion into over 80 global markets, including key regions in Africa and Asia.

Activation: Branding across Emirates Stadium, digital campaigns, co-branded content, and fan engagement experiences.

Owner of Guinness: Guinness is owned by Diageo plc, a British-based global beverage company.

Owner of Arsenal Team: Arsenal Football Club is owned by Stan Kroenke through his holding company, Kroenke Sports & Entertainment (KSE).

Duration: Well, we know it’s a multi-year agreement starting from the 2025–26 season. But for how long? While Arsenal and Guinness haven’t revealed the exact length, we can guess that it might be long term. But how? Based on how football sponsorships usually work. Big deals, like Manchester United’s 10-year contract with Adidas or Chelsea’s 15-year partnership with Nike, are long hauls, especially when major global brands are involved. Guinness might not appear on the shirt, but category deals like this usually span 3 to 5 years—sometimes longer, if the ROI pours in.

ADVERTISEMENT

Article continues below this ad

How Guinness compares to Arsenal’s biggest partners

1. Emirates:

Arsenal has been partnered with Emirates since 2006, with the airline’s name also branding the stadium – a deal formally extended until 2028.

Financially, the shirt sponsorship is worth around £50 million ($66.73 million) per year, with stadium naming rights and training kit inclusions pushing it past £60 million annually ($80.08 million), plus performance-linked bonuses.

2. Kit Manufacturers – Puma & Adidas

In 2014, Puma signed a five-year deal worth approximately £170-201 million ($226-268.31 million), generating around £40-45 million ($53.40-60.07 million) per season for kit and merchandise rights.

Adidas took over the kit partnership in 2019, reportedly worth £67 million ($89.44 million) per year via a contract running into 2030, making it one of football’s high‑value apparel agreements.

ADVERTISEMENT

Article continues below this ad

What’s your perspective on:

Can Guinness' cultural branding with Arsenal outshine the financial might of Emirates and Adidas?

Have an interesting take?

So, is Guinness a big deal compared to Emirates or Adidas? In terms of money and visual dominance, no, it doesn’t match the scale of Emirates or Adidas. But in terms of cultural branding, lifestyle activation, and strategic global reach, especially in emerging football markets, Guinness might be a game-changer.

ADVERTISEMENT

Article continues below this ad

What do 100 million Arsenal fans mean for Guinness 0.0?

Arsenal isn’t just a football club, it’s a global force with a large fanbase of over 100 million supporters (102.7 million, to be exact, according to FootballGroundGuide. That puts it among the most-followed clubs in the world, even if giants like Real Madrid top the chart with over 423 million followers. But Arsenal’s reach still makes it a dream partner for global brands, especially for Guinness, which has been making a serious push into sports marketing and non-alcoholic drinks. So, why Guinness and why now?

Guinness 0.0 is at the heart of that story. Guinness 0.0, first launched in 2020. But hit a bump with a brief recall due to a production safety issue. But came back stronger in mid-2021 in Ireland, and shortly after in UK supermarkets. Since then, it’s been rising. By mid‑2024, European net sales had more than doubled, and it had become the UK’s best-selling non-alcoholic beer, with off-trade sales jumping nearly 110% to $44.52 million in just one year. Backed by a $34.90 million investment from Diageo to expand production, Guinness is clearly eyeing the global stage. But can this partnership help Guinness not only ride Arsenal’s global wave but amplify it?

ADVERTISEMENT

Article continues below this ad

Well, this Arsenal x Guinness deal is a calculated global rollout, and the map is already unfolding.

First stop: Singapore sets the tone

ADVERTISEMENT

Article continues below this ad

During Arsenal’s 2025 pre-season tour, Guinness brought the partnership to life at Molly Malone’s Irish Pub. That was an iconic venue, and more than 300 Arsenal fans showed up.

Meanwhile, across the Atlantic… big numbers brew

ADVERTISEMENT

Article continues below this ad

While fans cheered in Singapore, Guinness was doubling down in Dublin, literally. In October 2024, Diageo invested around €30 million (about $34.74 million) to double production at Dublin’s iconic St. James’s Gate, scaling output to 176 million pints a year to meet rising demand, especially in North America. That brings their total investment in Guinness 0.0 to over €60 million (approximately $69.47 million) since its launch.

But what about the sales?

Guinness 0.0 is now the UK’s best-selling non-alcoholic beer.

Across Europe, net sales more than doubled in the same window.

Back home in Ireland?

- Draught sales surged 48.7% from Feb 2023 to Feb 2024.

- Availability shot up from 250 to nearly 1,400 pubs, with a target of 2,000+ by the end of 2024.

But how close are they really to catching their rivals?

Where does Guinness stand among beer giants?

| Brand | Partner | EST. value | Strategy |

| Heineken | UEFA Competitions | $70M | Premium legacy presence |

| Budweiser | Manchester United | $1M (not officially disclosed but rumored to be) | Youth and emerging market focus |

| Guinness | Arsenal FC | $5.34 million+ | Cultural integration, lifestyle |

Why do these sponsorships matter so much now?

Because in modern football, sponsorships are no longer just about shirts and signage. They’re about survival, identity, and expansion. In the 2024-25 season, Premier League clubs collectively brought in around £1.58 billion ($2.11 billion) from sponsorships. For many top clubs, including Arsenal’s total club revenue rose 32 % year‑on‑year, reaching £616.6 million in 2023–24. Matchday revenues rise and fall. Broadcast rights get sliced thinner. But strong sponsorships? They keep the engine running.

Why is alcohol everywhere in sports?

Income? Absolutely! Well, back in 2023, Alcoholic beverage brands generated $147.26 million in sports sponsorship revenue across the APAC region. Along with Football, which accounted for $32.59 million (22%) of that spend. So, yes, Soccer remains the most lucrative segment in regional sports sponsorship. And believe it or not, non-alcoholic beer sponsorships are on the rise globally. In the UK, sales of low and non‑alcoholic beers jumped by 23% year-on-year, and have more than doubled since 2019.

Ladder to Revenue:

- Arsenal reported a record £616.6 million ($822M) in total revenue for the 2023–24 financial year, up from £466.7 million ($622M) the previous year.

Commercial and sponsorship revenues specifically rose from £169.3 million ($225M) in 2022-23 to £218.3 million ($291M) in 2023-24, accounting for around 36% of total revenue.

So is this just another beer deal? Hardly. With £616.6 million in revenue last year—and over 100M global fans—Arsenal is now more than a club; it’s a content and culture engine. And Guinness isn’t just buying into football. It’s buying into moments, moderation, and meaning.

Can Guinness' cultural branding with Arsenal outshine the financial might of Emirates and Adidas?