via Imago

Image Courtesy: IMAGO

via Imago

Image Courtesy: IMAGO

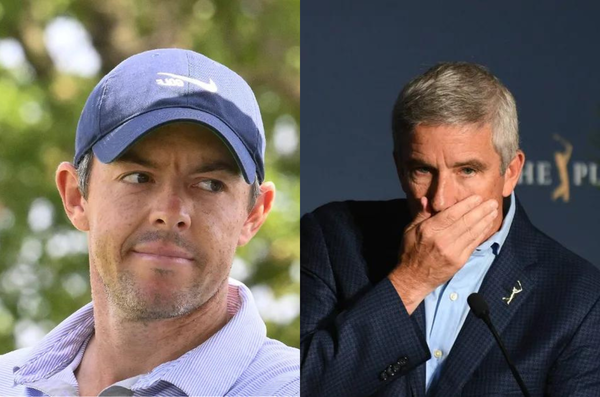

You probably thought Rory McIlroy had said whatever he had to say on the Overlap podcast. Enough verbal jousting, Ryder Cup notwithstanding, and not nearly enough on-course performance have hammered home the point for McIlroy that he needs to focus on matters inside the ropes more than off the ropes. But the 34-year-old was not done yet.

If the Overlap podcast was his recapitulation of the past “mistakes,” the Golf Digest interview from the Dubai Creek Resort was his outline for the future. An important standout from his multifaceted vision for the future was improving the Tour’s revenue. But how feasible are they when the Tour is seemingly on its back foot and looks to compromise not just with LIV Golf but other sports as well?

ADVERTISEMENT

Article continues below this ad

Is the Tour losing faith in its product?

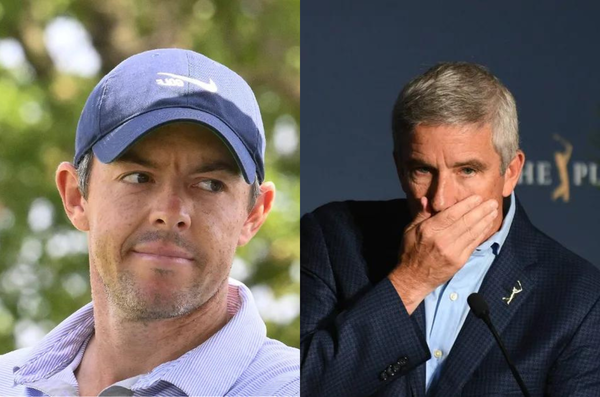

The PGA Tour was aggressive in fighting with LIV Golf at first. The gusto with which Monahan banned the top players and filed countersuits evinced that. However, despite throwing $20 million in the courtroom battles, Tour was still not able to move the LIV Golf from its stated position a bit. The chaos unleashed on the golf world has a ripple effect; the Tour has been playing on the defensive in other areas as well.

Poll of the day

Poll 1 of 5

AD

Take The Sentry, for example. Andy Johnson of the Fried Egg Golf Podcast pointed out that the Tour moved its broadcasting schedule ahead so as not to clash with the NFL. That too, when the NFL is in its 18th week and the football has waned from the first-week peak, with many teams already in contention for playoffs.

This weekend, the PGA Tour opted to move up television coverage of The Sentry to avoid running up against Week 18 of the NFL season.@AndyTFE from this morning's newsletter:

Running Scared

Is it too much to ask that the PGA Tour have some pride and confidence in their product?…

— Fried Egg Golf (@fried_egg_golf) January 8, 2024

Cowering down in this scenario sends a strong signal that the management board, rather than gaining a new audience, is more focused on retaining the audience it already has. Whereas, the data points out that viewership only increased during the Tour.

CBS has recorded a 4% year-over-year jump in PGA Tour viewership that crossed the $2.5 million mark last year. Furthermore, Sports Pro Media revealed that footfall on the PGA Tour’s website has increased by 8%, whereas the iOS download has increased by 60%. If the top brass is not ready to cash in on the opportunity, McIlroy’s wish to increase the $2.3B revenue to “four or six” is bound to hit the skids. Rather than leveraging the opportunities, Monahan & Co. is putting the squeeze on already beleaguered sponsors.

The PGA Tour’s sponsorship problems can jeopardize McIlroy’s vision

McIlroy, among many things, also pointed out how greed is killing the game. The lavish purses of the Signature events have come at a high cost. Tour management is asking sponsors to contribute more to a product, but they don’t see any proportional return. And “investors always want to make a return on their money,” as McIlroy pointed out. Honda and Wells Fargo were the first two to end their relationship with the Tour.

Rory sat down with @WeAreTheOverlap for an hour interview.

He was asked if he’s lost any friends because of LIV https://t.co/qdGRnFbGn5 pic.twitter.com/wawKKLTCxw

— Rory Tracker (@RoryTrackr) January 3, 2024

Words inside the circles suggest more sponsors are hot under the collar with Monahan’s arbitrary demands. The Tour is asking for $20 million to $25 million for crucial events. However, the increased purse size has not always translated to increased interest among golfers. With a wide field, in any event, the sponsors are not seeing good ROI.

At last year’s Honda Classic, which will be renamed the Cognizant Classic this year, only three of the top 20 and eight of the top 50 players teed up. Moreover, Wells Fargo, too, was willing to retain its ties. However, the Tour’s sky-high demand was the final straw. In fact, Nike’s rumored departure from golf also points toward a dismal picture.

ADVERTISEMENT

Article continues below this ad

What will Nike’s exit from golf spell for the PGA Tour?

In the last two weeks, Nike has lost two of its biggest stars. As seen from the other side, Nike Golf has let two of its biggest stars go. The Oregon-HQ brand, notably, didn’t deliver what it promised in 2022. A shoe that fits Tiger Woods’s needs.

On top of that, the company has been laying off employees for the past few months. Moreover, NBC reported that Nike’s stock has fallen over 40% since 2021. The apparel giant has initiated $2 billion in cost-cutting measures, and Woods’s departure gives the clearest signal that the brand is perhaps leaving golf.

Read More: Golf On a Global Scale: Does LIV Golf Pros’ Claims of ‘Growing the Game’ Hold Up?

ADVERTISEMENT

Article continues below this ad

Nike’s disinterest in the golf business—most of the brand’s players are currently signed with the PGA Tour—also signals a departure that might potentially have a knock-on effect. Commentators point out that losing a big name like Nike will have a bearing on upcoming and current sponsors’ future investments. The Tour is in dire need of course correction. No one understands it better than Rory McIlroy at this point.

Watch This Story | LIV Golf News: 3 Major Takeaways as the $3B PGA Tour-PIF Merger Deadline Gets Extended, as Per Reports

ADVERTISEMENT

ADVERTISEMENT

ADVERTISEMENT

ADVERTISEMENT