Imago

Image Credits: Imago

Imago

Image Credits: Imago

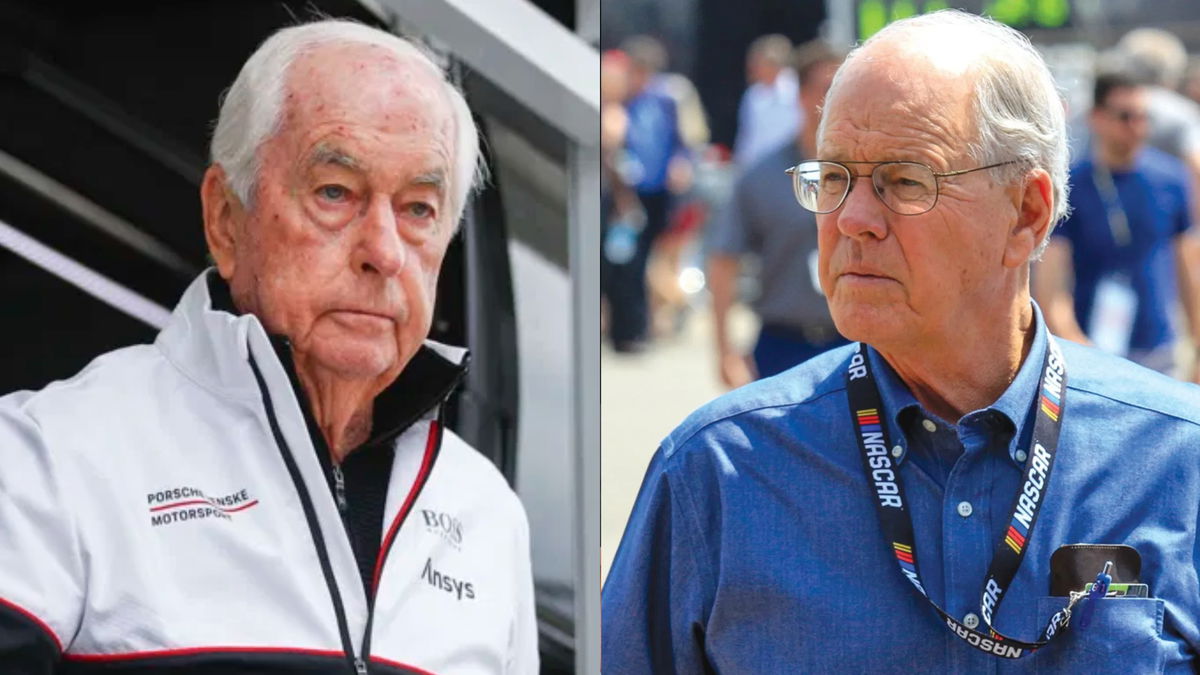

When business acumen meets racing passion, Roger Penske’s name resonates louder than any other. The owner of Indianapolis Motor Speedway and Penske Corp. has been a force to be reckoned with in the motorsport community. Beyond championship-winning Team Penske entries across IndyCar, NASCAR, IMSA, and WEC, Penske Corp. operates a logistics business and auto dealerships, including being one of the nation’s largest BMW dealers. The global transportation powerhouse with over $43 billion in revenue, 3,300+ operating locations, and upward of 73,000 employees across automotive retail, truck leasing, logistics, and racing ventures. Penske Entertainment, a Penske Corp. subsidiary, acquired the IMS and IndyCar in 2019, setting the stage for a vertically integrated motorsports powerhouse under Penske’s leadership. That legacy underpins the current expansion with Fox.

Watch What’s Trending Now!

Over the years, IndyCar’s series has seen its broadcast rights move through a tapestry of television partners. Originally aired in the late ’90s by ABC, BCS, ESPN, TNN, and even Fox Sports Net, the league eventually settled with ABC/ESPN for almost a decade from 2000-2008. From 2009 through 2024, NBC held exclusive rights, offering solid visibility but often relegating practices and qualifiers to cable or streaming platforms. Despite the steady growth, many felt IndyCar lacked nationwide prime-time consistency until Fox stepped in for 2025. It promised full network broadcasts of all 17 races as the only major U.S. motorsport series entirely on broadcast television. But now comes the game-changing announcement.

Fox Corporation acquired a one-third stake in Penske Entertainment, with the investment valued at $125 million to $135 million, alongside a multi-year extension of Fox’s media-rights deal. “This partnership is built on long‑standing trust and a shared vision for the future,” Penske said. “FOX sees the incredible potential across our sport and wants to play an active role in building our growth trajectory.” Echoing that, Fox Sports CEO Eric Shanks emphasized the series’ growth potential, highlighting Fox’s commitment beyond broadcasting into digital content, events, and sponsor integration. “The blueprint is there. We know what this sport can be,” Shanks said.

Imago

Image Credits – Porsche Motorsports, X

And the numbers back it all up. In its first season on Fox, the 2025 Indianapolis 500 averaged 7.01 million viewers, marking a 41% raise from the 2024 race on NBC and the highest viewership in 17 years, Through the first half of the 2025 season, IndyCar viewership climbed 31% year-over-year, while flagship events like St. Petersburg debuted with an average of 1.417 million viewers, up 45% from a comparable NBC audience of 975,000. While some races, including Mid-Ohia, came in under expectations, the aggregate viewership over just 10 races already hit 15.01 million, slightly eclipsing the 14.85 million total for the entire 2024 season across multiple networks. Discussion forums argue that averaging even modest network-level races of 860k would yield total season viewership of 5.5 million, which is 3.9 million higher than in previous seasons.

For fans, this deal represents more than ratings; it signals stability, visibility, and ambition. IndyCar now boasts a broadcast partner with skin in the game, ready to champion its growth through fresh storytelling, engagement tools, and marquee events. With Penske and Fox aligned on a vision, fans can hope for innovation both on and off the track, perhaps even reality series or immersive experiences that attract new audiences and redefine motorsports entertainment. But right now, fans seem a little split over the breaking news, warning Jim France and Co. from following the same path.

How IndyCar loyalists view the new Fox era

Some fans expressed skepticism, suggesting Fox’s move is purely corporate, as one wrote, “I don’t know if this is a good thing or a bad thing for IndyCar. Slightly leaning towards this might be a bad thing.” This comment reflects the unease that a network with financial stakes in the sport may prioritize programming or promotional goals over racing authenticity and competitive balance. With Fox now holding ownership with Team Penske alongside media rights, fans worry that broadcast strategies, like excessive commercial breaks and missed critical moments during the 2025 Indy 500. This would show a shift away from pure racing in favor of viewer grabber tactics, especially when broadcast blunders threaten the purity that fans value the most.

Another fan added, “ESPN and FOX have taken monetary interest with other sports like PLL and UFL, this is really interesting. It won’t be the last I am sure.” Media giants ESPN and Fox are increasingly moving beyond broadcast contracts into ownership roles with emerging sports leagues. In June 2025, ESPN not only renewed its media rights deal with the Premier Lacrosse League through 2030 but also acquired a minority equity stake in the league, signaling long-term investment in both men’s and women’s lacrosse. Meanwhile, Fox Sports formally owns approximately 42% of the United Football League, a rebooted spring football league formed from the merger of the XFL and USFL. So, the shift of interest to motorsports has been intriguing for some.

While others brought their focus back to motorsports, saying, “I wish NASCAR would kick Fox to the curb. Let NBC have the Daytona 500 and Prime have the first half of season.” Viewers have criticized Fox for excessive commercial breaks, missed live crashes, camera angles that zoom in too tightly during key moments, and generally lackluster production quality. For example, during the 2025 Atlanta race broadcast, fans called it “unbearable” and lamented that Fox missed a crash live because it aired a sponsored segment instead. Sentiment on anti-Fox forums has intensified further since Amazon Prime and TNT delivered crisp, engaging coverage for several races. On the other hand, some suggest that NASCAR should return the Daytona 500 to NBC’s hands for its polished presentation as well. But the overall sentiment has been critical for all platforms by different demographics.

One added to the sentiment, saying, “I’d like to know what NASCAR executives think of this, especially with lackluster broadcasts this year. Between this and the breakup of Warner Bros. and Discovery, I wonder if they are starting to have some regrets with the current media deal.” The broader media landscape is in upheaval highlighted by Warner Bros. Discovery’s spiritual breakup of its TV networks, that still carry NASCAR events, like TNT. Analysts suspect that this restructuring may signal shifting priorities away from linear sports partnerships, adding to NASCAR’s concerns about stability and fan interest.

While NASAR’s $7.7 billion media rights package may bring financial security, it’s clear some within the sports are questioning whether the on-track experience and broadcast quality are sacrificed to appease television executives. One fan warned, “The Frances better not get ANY ideas.” With younger fans already frustrated by TNT’s tactics in recent NASCAR races and traditional fans struggling with Amazon Prime’s navigation, skepticism now extends toward Fox’s potential pitfalls. Concerns linger that IndyCar’s new broadcast home may mirror challenges seen with other media partners.

As IndyCar steps into this bold new chapter with Fox, the stakes go beyond just viewership numbers, The series now faces the delicate task of blending broader exposure with a seamless fan experience that keeps audiences engaged. If executed well, this partnership could mark the start of IndyCar’s most transformative era yet.