Imago

Images via IMAGO

Imago

Images via IMAGO

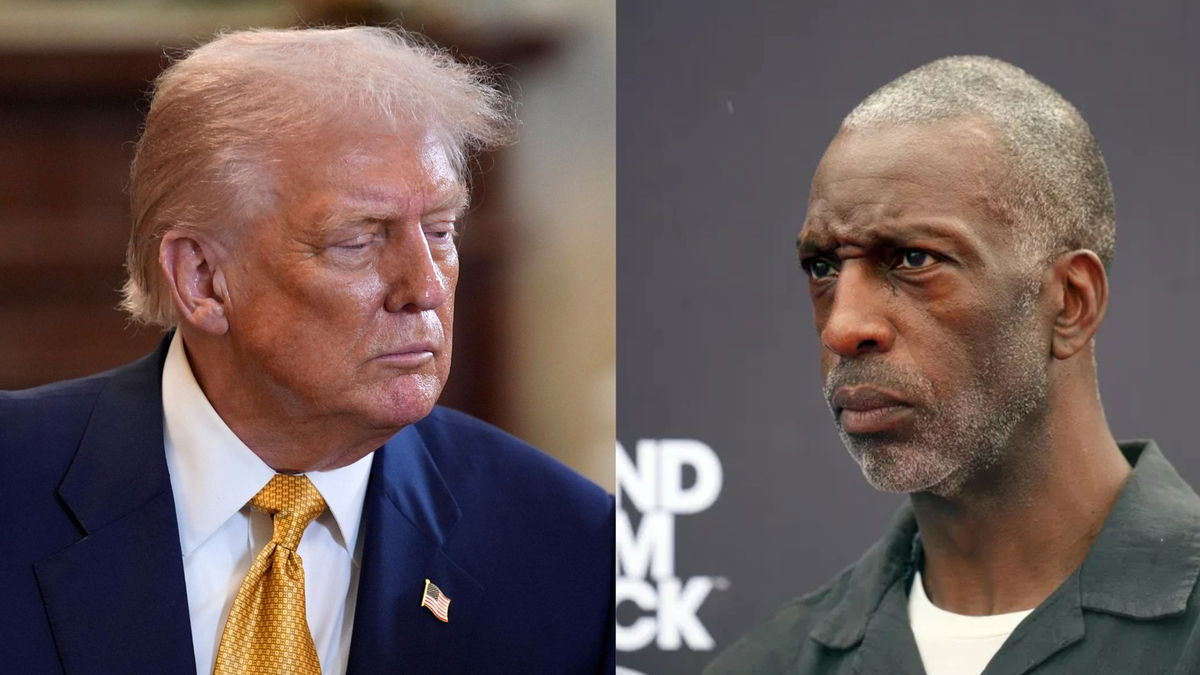

It began with ambition: prime-time slots, million-dollar incentives, and a charismatic founder whose resume read like a history book. Grand Slam Track promised to be the antidote to track and field’s institutional drag. A modernized league tailored for stars, and carried by the stars. But behind the confident branding and brisk promotion, a more brittle framework quietly waited to give way. And now it has, with Michael Johnson, the face and force behind the venture, finally offering a sobering explanation for why the wheels came off…

Watch What’s Trending Now!

In June, the league abruptly canceled its Los Angeles event. The final meet of its debut season sparked unease among athletes and stakeholders. A closed-door meeting followed. The public line from organizers at the time was one of optimism and adjustment. Yet cracks had already emerged weeks earlier, starting with a poorly attended launch in Jamaica and a subsequent financial shortfall in California, where hosting costs threatened to sink the entire budget. Had the Los Angeles leg gone forward, estimates suggest Grand Slam Track might have absorbed over $2 million in additional losses. By halting the event, the league salvaged roughly $2.5 million, mostly in unpaid prize money and travel expenses. Still, this brief reprieve only masked deeper issues.

ADVERTISEMENT

The root cause, as Johnson now acknowledges, was neither mismanagement nor overreach alone. It was an economic pivot far outside sport’s usual frame of reference. In a revealing recent statement, Johnson admitted that the league’s financial model suffered a major blow in April following Donald Trump’s global tariff announcement. “We saw a bit of a seismic shift in the economy due to tariffs,” Johnson explained in a conversation with Front Office Sports Today. “It was really late for us to be able to pivot when that happened and when we lost that investor’s commitment,” he further added. The investor in question had signed an eight-figure term sheet after attending the league’s launch in Kingston. But days after Trump’s tariff speech, they pulled out, opting to redirect funds elsewhere. Johnson noted that broader market volatility also made existing backers wary. “There’s a lot of uncertainty right now, and that causes people to sort of pull back,” he said.

GST’s schedule only intensified the strain. With just a month between events, the league was locked into a demanding pace that left no time for correction or recalibration. Once the investment gap opened, there was no buffer. “Put us under a lot of pressure from day one,” Johnson said, referring to the compressed timeline. The warning signs became unmistakable in Miramar, Florida, where the league hosted an event in May. Public records reveal that Grand Slam Track failed to pay its facility rental fees, $30,000 due on July 18, with a total outstanding balance of $77,896. This default followed a revised payment plan designed to give GST breathing room, and its failure to comply has raised alarms about its remaining capital.

ADVERTISEMENT

Imago

Image via Instagram/@grandslamtrack

and @mjgold4

At its inception, Grand Slam Track was fueled by over $30 million in funding, with cities like Kingston, Miami, and Philadelphia providing $9.45 million in local support. But this war chest has proven inadequate in a financial landscape that is less predictable than even the sport’s tightest finishes. Johnson’s willingness to now address the league’s fragility. Publicly and without spin, it marks a notable shift in tone. For all the charisma and control that defined his racing days, the hallmarks of his leadership here may well be transparency and restraint. Whether that’s enough to bring Grand Slam Track back for another lap remains, like much of its season, unresolved.

ADVERTISEMENT

How Trump’s tariffs might be reshaping the cost of playing and affect Michael Johnson’s venture

It begins with a pair of basketball shorts. Or maybe a hockey stick. In either case, the item has crossed oceans before making it to the shelf. What was once a straightforward supply chain has become a slow, expensive grind and has been rerouted by the Trump administration’s tariff policy. Those who run youth leagues, manage sports franchises, or even sell sneakers in retail outlets now face a growing burden: cost inflation driven by import levies that threaten to outpace consumer appetite.

ADVERTISEMENT

Imago

Credit: X/@respective owner

The sporting world, by its very nature, operates on imports. Jason Messar of B&R Sports stated plainly, “Pretty much everything is coming from outside the U.S., made in China, Vietnam, Canada, Mexico.” His suppliers expect a price bump of four to eight percent on core gear. In isolation, that figure may seem manageable. But across thousands of SKUs and millions of customers, it becomes unworkable. ESPN data indicates that 61 percent of all sports goods imported to the U.S. last year came from China alone. Combined, Mexico and Canada contributed $746 million worth of goods. That ecosystem now stands disrupted.

ADVERTISEMENT

The NBA, NHL, and golf industries are already seeing signs of friction. Joe Pompliano noted, “Golf equipment company Topgolf Callaway Brands, which uses parts from China for some of its products, is anticipating a $5 million headwind on its EBITDA this year.” Meanwhile, as tariffs pressure the Canadian dollar, valuations of NHL franchises with deep Canadian ties may suffer. A quarter of NHL revenue originates from Canada, and any economic strain there has ripple effects on league equity. Even merchandise, long a stable profit center for leagues, is wobbling. With 97 percent of U.S. apparel imported, brands must either erode their margins or raise prices to unsustainable levels.

This pressure extends beyond brand statements and boardrooms. It hits golf bags and football cleats, sneakers and jerseys. Cuts Clothing founder Lloyd Lee explained that to maintain margins under the new rules, a $50 item may have to sell at $79. This is not theoretical. It is already happening. From high school athletics programs to casual fans at big-box stores, access to sports is narrowing. As tariffs climb and negotiations stall, what used to be a question of performance is quickly becoming one of affordability.

ADVERTISEMENT

ADVERTISEMENT

ADVERTISEMENT

ADVERTISEMENT