Imago

Image Credits: Imago

Imago

Image Credits: Imago

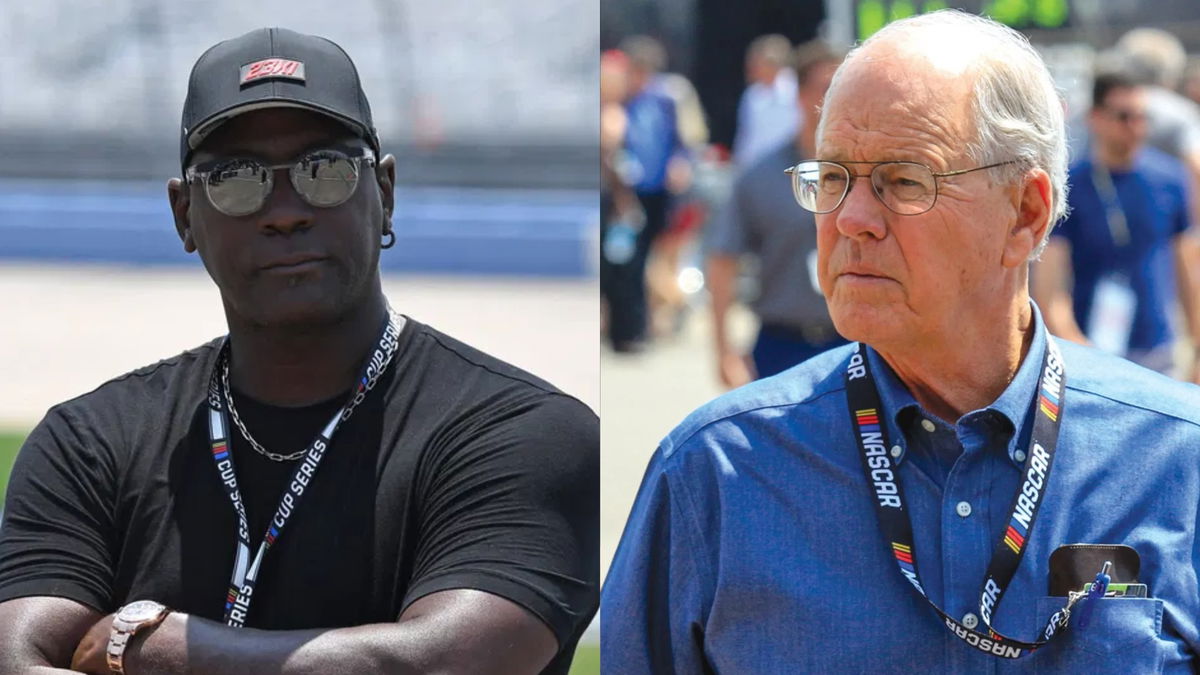

The teams might be busy playing checkers in the NASCAR world right now, but the courtroom is playing something much more complicated and a whole lot higher stakes. As we stand on the eve of the antitrust battle between 23XI Racing/Front Row Motorsports and NASCAR, a quiet twist has emerged. The biggest advantage the plaintiff might have come from NASCAR’s own words. Before the jury even takes the seat, the legal board has shifted in ways no one expected, and one legal expert didn’t shy from pointing it out.

Watch What’s Trending Now!

Attorney McMinimee backs Judge Bell’s judgment on market definition

Speaking on the Teardown podcast, Shannon McMinimee broke it down.

ADVERTISEMENT

“I think that was a smart choice for Judge Bell,” she said. “Because should the matter end up on appeal, that’s one of those decisions that an appeal court will look at for the first time under a standard called de novo. And the fact that he chose to use the definition that NASCAR put forward to him goes in favor of that decision being held to be appropriate. So big, big question already resolved before trial.”

Long before the trial begins, a court has already accepted one of the central contentions underlying the lawsuit by 23XI Racing and Front Row Motorsports. That NASCAR possesses monopoly power over a narrowly defined market known as “premier stock car racing.”

In November 2025, federal judge Kenneth Bell granted partial summary judgment for the plaintiff, agreeing that the relevant market is “premier stock car racing” (i.e., the entry of cars into NASCAR Cup Series races) and finding that NASCAR holds 100% market share in that market.

ADVERTISEMENT

Imago

Bildnummer: 13973256 Datum: 12.07.2013 Copyright: imago/HochZwei

Motorsports / DTM: german touring cars championship 2013, 5. Race at Nuernberg, Norisring, Jim France (NASCAR, Grand AM) xHOCHxZWEIx/xJuergenxTapx ; Motorsport DTM Nürnberg Norisring xcb x0x 2013 quer Motorsport – motor Partner01 Weltmeisterschaft – World Championship DTM – Deutsche Tourenwagen Meisterschaft Meisterschaft – championship Rennen – Race Randszene – side issue Randmotiv

Image number 13973256 date 12 07 2013 Copyright imago Motorsports DTM German Touring Cars Championship 2013 5 Race AT Nuernberg Norisring Jim France Nascar Grand at xHOCHxZWEIx motor aviation DTM Nuremberg Norisring x0x 2013 horizontal motor aviation Engine World Cup World Championship DTM German Touring Car Championship Championship Championship Race Race Edge scene Side Issue Rand motive

This means that the market definition can’t be contested in court, as it’s implied that NASCAR acts as the sole buyer of services from competing race teams.

ADVERTISEMENT

What remains for trial, then, is not whether NASCAR is dominant but whether the sanctioning body unlawfully exercised that dominance by imposing unfair restraints on trade via the charter system, denying teams economic benefits, or structuring participation in ways that disadvantage certain teams.

“So, having to prove that NASCAR’s monopoly no longer on the table and that this is about the top level of racing in the United States, and that’s defined by the national NASCAR touring series. Already resolved,” McMinimee added.

Moreover, and importantly, for appeals or future judicial scrutiny, Judge Bell based his decision on definitions that came directly from NASCAR on filings.

ADVERTISEMENT

The court operated NASCAR’s own entry into the NASCAR series definition of a relevant market, a strategic choice because that means the plaintiffs aren’t arguing a novel or artificial market; they are using NASCAR’s admitted scope.

That alignment could make it harder for NASCAR to argue later that the market definition was contrived or unfair, strengthening the plaintiff’s position. But regardless of the outcomes, NASCAR will never look the same again.

Top Stories

Greg Biffle’s House Burglary Suspect Identified After Officials Release Security Camera Footage – Report

Bubba Wallace’s $218.94B Sponsor’s Exit Triggers Unlikely 23XI–NASCAR Partnership

NASCAR Team Faces ‘Boycott’ After Veteran Driver Gets Fired

NASCAR Fans Celebrate as Jack Roush Makes History With Second Bill France Award

Veteran NASCAR Driver Concedes to 15 YO Phenom with Bold “Replacement” Verdict

ADVERTISEMENT

What are the possible outcomes?

The lawsuit could still be resolved at any stage, even after a jury verdict or during an appeal, meaning a settlement remains on the table, no matter how far the process moves.

If 23XI Racing and Front Row Motorsports prevail, the jury would calculate the financial damages, which Judge Kenneth Bell could adjust or even triple under antitrust law. He will also be responsible for deciding how to unwind any monopoly the court determines exists.

That opens the door for sweeping remedies such as forcing the family to divest from NASCAR, requiring the sale of NASCAR-owned tracks, restructuring or eliminating the charter system, or even mandating permanent charters. Almost anything becomes a legal possibility.

ADVERTISEMENT

On the other hand, if NASCAR wins the case, the future looks far more uncertain for the two teams. Industry insiders suggest both teams may not be able to continue beyond 2026, and the six charters currently being withheld would almost certainly be sold off to new buyers.

With the most recent charter fetching $45 million and significant interest from investors, including private equity, NASCAR would have no shortage of suitors ready to step in. And now, as we’re just hours away from the lawsuit trial, all eyes and ears are going to be fixed as the organization’s future lies with the jury.

ADVERTISEMENT

ADVERTISEMENT

ADVERTISEMENT