Imago

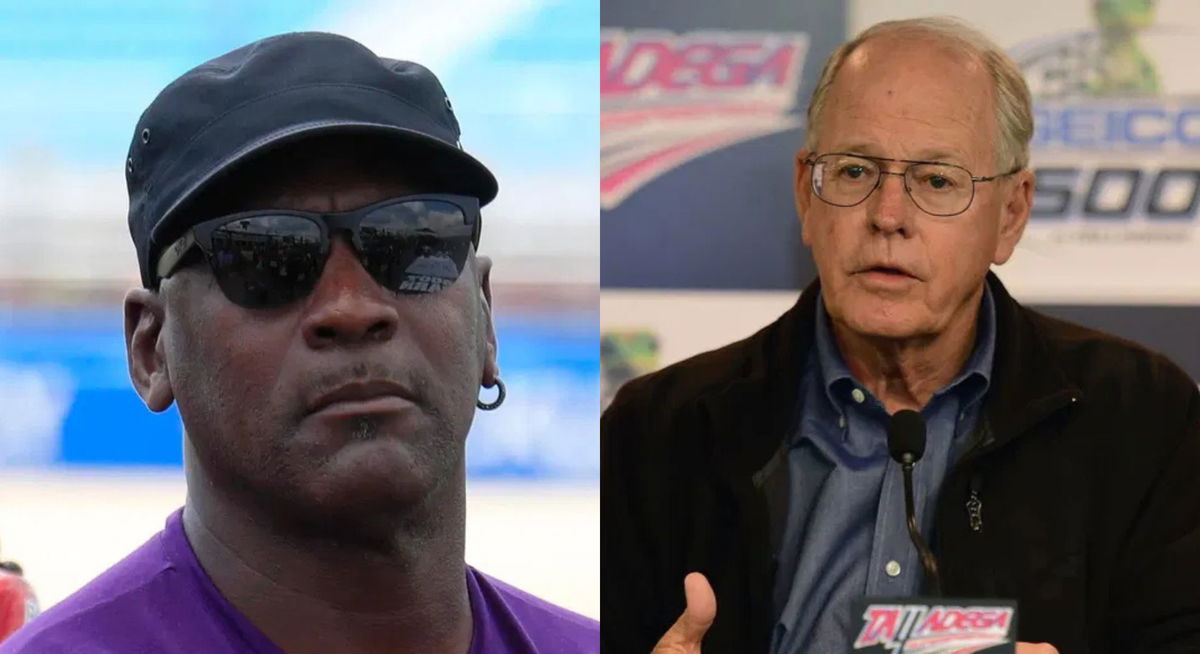

michael jordan jim france

Imago

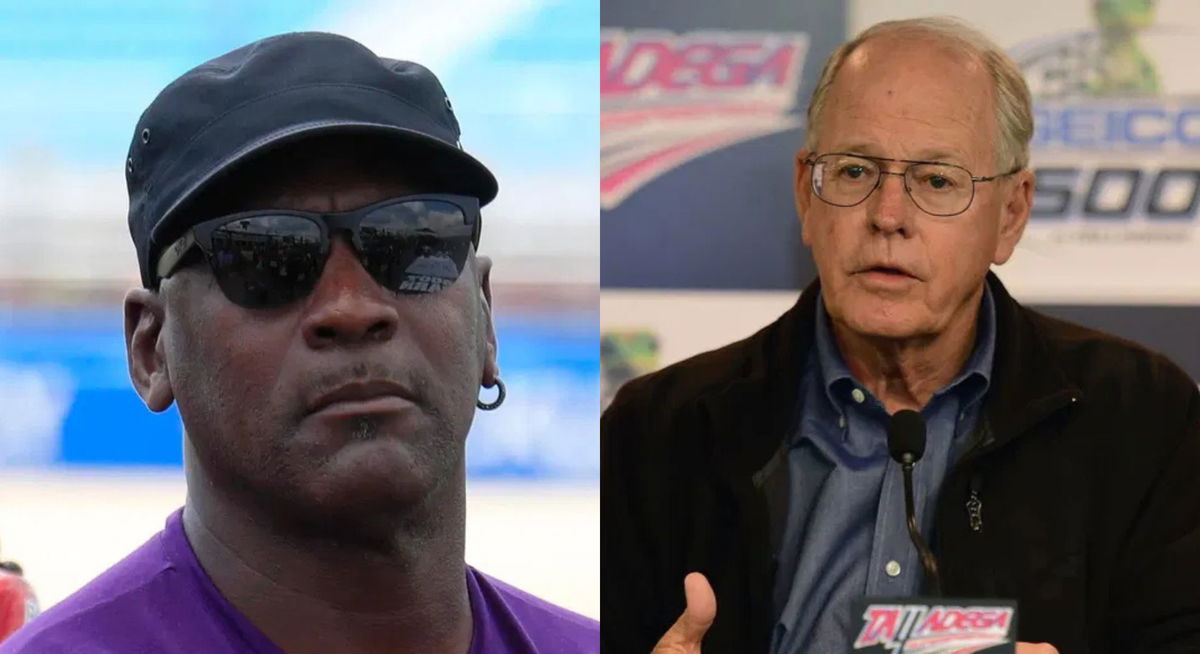

michael jordan jim france

Imago

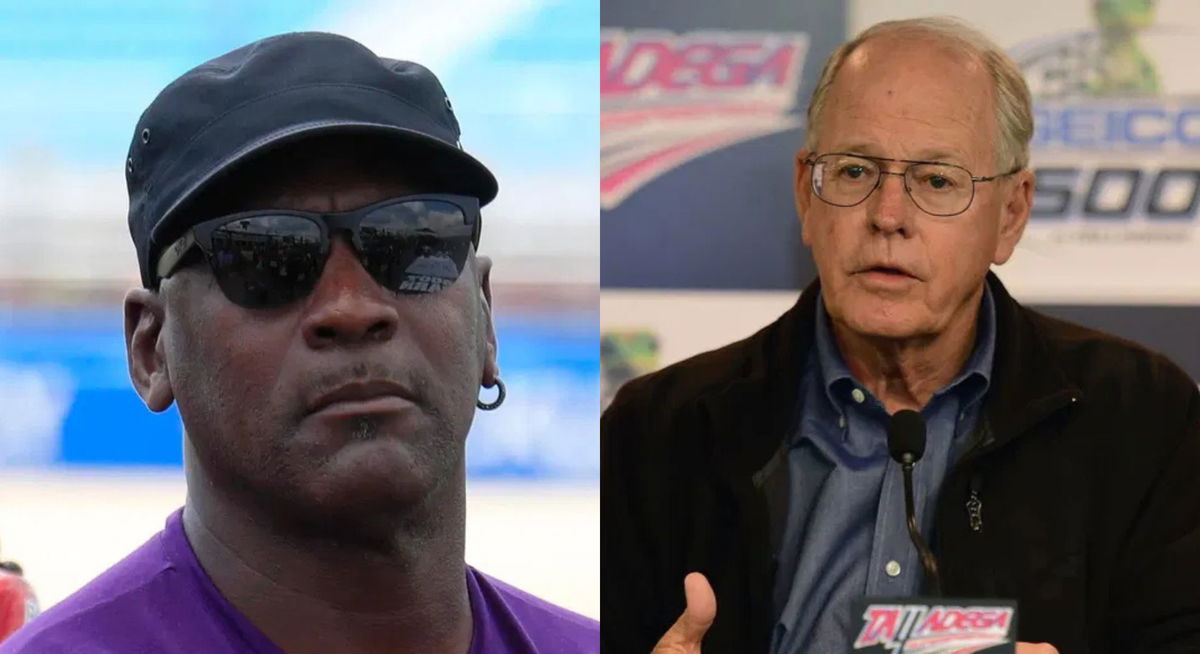

michael jordan jim france

Imago

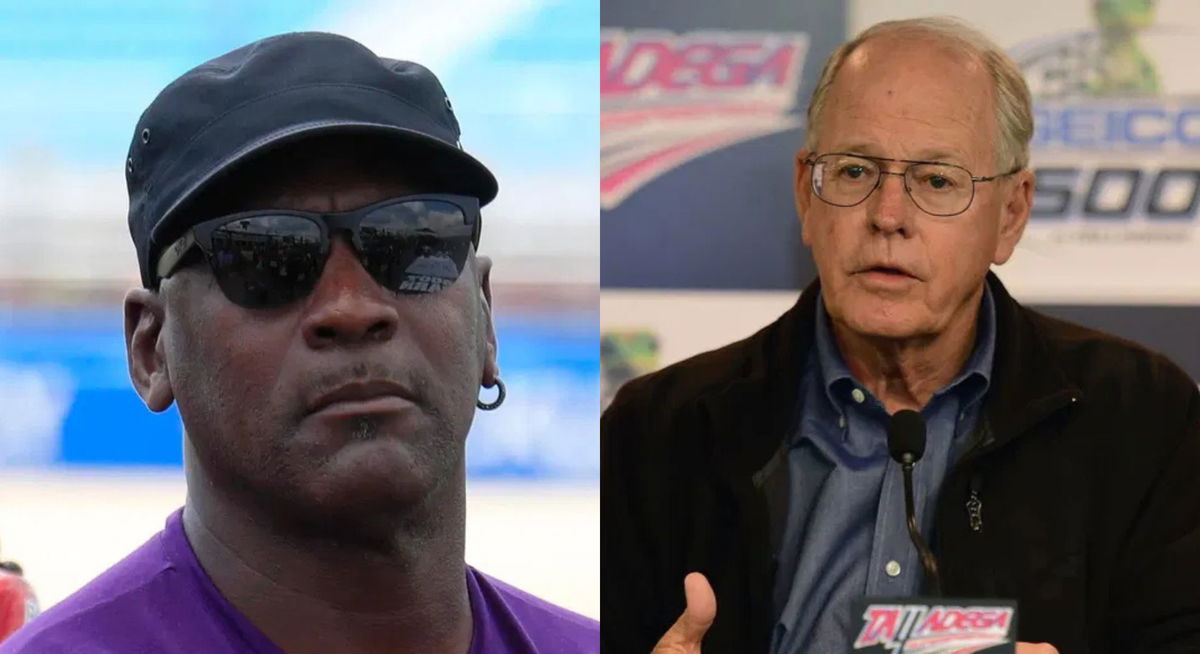

michael jordan jim france

The NASCAR antitrust lawsuit saga involving Michael Jordan’s 23XI Racing and Front Row Motorsports keeps heating up, with the courtroom battles showing no signs of slowing down. Tensions spiked after a federal judge in Charlotte denied the teams’ (23XI and Front Row) request for a preliminary injunction on September 3, 2025, leaving them without chartered status for now. “The uncertainty about what the 2026 season will look like unfortunately exists not just for the Parties, but for the other teams, drivers, crews, sponsors, broadcasters, and, most regrettably, the fans,” Judge Kenneth D. Bell noted in his ruling. And now, with another update coming in from the teams and the judge, it looks like the case might eventually end up in a trial indeed.

Watch What’s Trending Now!

That preliminary injunction denial came after an August 28, 2025, hearing where Bell expressed reluctance to tip his hand on the merits to avoid biasing a jury. The teams had pushed for the injunction to secure their spots and prevent NASCAR from selling their six combined charters, but Bell cited NASCAR’s pledge not to do so until resolution as reason enough to hold off. This move underscores the high stakes, as open teams earn far less, potentially $1.5 million less per charter, and face qualifying risks. Yet, recent filings hint at more aggressive plays from the teams’ side, setting up a pivotal next phase in the legal tussle.

Latest twists push case toward a full trial

Bob Pockrass dropped a key update on X, revealing, “While judge indicated he’d likely deny summary judgment motions in 23XI/FRM-NASCAR case, 23XI/FRM/Polk filing today on proposed page limits indicates it will ask for summary judgment to throw out NASCAR’s counterclaim that teams illegally colluded to obtain better charter terms.” This signals the teams, represented by lawyer Jeffrey Kessler through Curtis Polk, are zeroing in on dismantling NASCAR’s March 5, 2025, counterclaim that accuses them of coordinating with drivers and sponsors to pressure for better deals, a claim Bell refused to dismiss earlier on June 25, 2025.

While judge indicated he’d likely deny summary judgment motions in 23XI/FRM-NASCAR case, 23XI/FRM/Polk filing today on proposed page limits indicates it will ask for summary judgment to throw out NASCAR’s counterclaim that teams illegally colluded to obtain better charter terms.

— Bob Pockrass (@bobpockrass) September 10, 2025

The background traces back to the teams’ refusal to sign the 2025-2031 charter extension, which boosts revenue share to 49% from 38-40% but still falls short in their eyes, especially with NASCAR‘s alleged antitrust violations like owning most tracks and mandating single-source parts. If successful, this targeted summary judgment could strip NASCAR of a major defense, forcing the core monopoly arguments into the spotlight at the December trial.

Michael Jordan & Co., including co-owner Denny Hamlin and Front Row’s Bob Jenkins, face a likely trial because Bell’s indication to deny broader summary judgments means the case won’t wrap up on paperwork alone, setting a precedent that these complex antitrust disputes demand full evidentiary hearings. In the last major development before this filing, the August 28 hearing led to the September 3 injunction denial, where Bell warned of no winners in litigation, stating, “As the Court noted at the hearing on this motion, the Court believes that it is best not to provide its forecast of the Plaintiffs’ likelihood of success on the merits, and thereby potentially bias the jury pool, unless it is necessary to do so, which it is not here.”

This ruling might encourage more teams to question NASCAR’s setup down the road, since it shows how tough it is to win on “irreparable harm” arguments when cash payouts could cover the damage instead. For 23XI and Front Row, running as open teams right in the middle of the season ramps up the stress, with sponsors and drivers possibly jumping ship, but going after that collusion claim is their way to shift the spotlight back to how NASCAR handles rivals, based on those internal papers from discovery that show a hard line against competition.

Backing up what Pockrass reported, that page-limit filing from September 10, 2025, sets up a move that might change how the case plays out by zeroing in on NASCAR’s collusion counterclaim, which points to supposed talks about boycotts. It all goes back to those 2024 talks where teams wanted a bigger voice, and it lines up with wider complaints in the sport, similar to the LIV Golf and PGA stuff Judge Bell brought up in past decisions.

If the judge drops it, that cuts into NASCAR’s edge, especially after they won their appeal on June 5, 2025, which threw out the first injunction and turned things in their favor. Bell has kept nudging both sides toward a deal, like he did in the June 17 hearing, which really highlights the tension, but since nothing’s settled, it’s heading to a jury that could make NASCAR sell off tracks or redo the whole charter system.

As things heat up in court, folks in the garage are starting to speak out about what all this might mean for the rest of the field.

Tommy Baldwin weighs in on lawsuit fallout

The latest developments have insiders buzzing about the deepening divide and what a drawn-out battle might bring to NASCAR’s landscape. Tommy Baldwin, competition director at Rick Ware Racing, captured the mood when he said, “I think you have two sides that are very strong-willed groups, and then you have two lawyers that have gone up against each other many, many times in these type of situations and don’t like each other.”

This points to the personal edges sharpening the fight, with Kessler and NASCAR’s legal team clashing repeatedly, much like in past sports antitrust cases. For smaller outfits like Rick Ware, the uncertainty hits hard, as charter values, pegged around $40 million, could plummet if the system unravels, affecting budgets and planning for 2026.

Baldwin didn’t hold back on the potential downside, predicting, “Unfortunately, I think it’s going to get worse, a lot worse, before it maybe going to get better.” His take resonates, given the judge’s warnings about no clear victors, especially with discovery revealing NASCAR’s internal views on suppressing competition. Teams fear a fractured paddock, where signed charter holders gain extra payouts while litigants scramble, potentially leading to sponsor pullouts or driver shifts that disrupt the on-track product.

Wrapping up his thoughts, Baldwin emphasized the high risks, noting the judge could reshape the sport entirely. This fallout prediction aligns with broader concerns that a trial verdict mandating changes, like opening up parts suppliers or allowing multi-series racing, might boost team revenues but at the cost of short-term chaos. As the December date nears, these reactions highlight a garage on edge, urging a resolution to keep focus on racing rather than courtrooms.