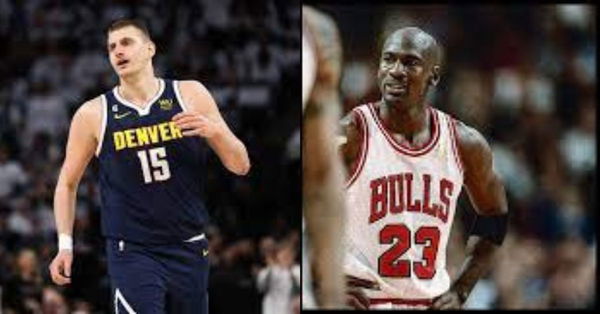

Losing $1,410,000 Due to Michael Jordan’s Dominance, Nikola Jokic Gets 49% of His $46.9M Income Taken Away Due to First World Reasons

Follow Us

via Imago

Image credits – Imago

Nikola Jokic has been the driving force behind the Denver Nuggets‘ dominating performances this season and bagged the richest deal in NBA history last July. Despite being in line to earn a whopping $46.9 million salary on paper next season, Jokic will lose $1.4 Million of it because of a peculiar reason involving Michael Jordan. The reason dates back to the early 1990s with a strange revenge story.

The top-seeding Nuggets stormed their way into the NBA Finals with only three losses in the postseason. While the odds favor Denver, the EC champions Miami Heat turned it around in Game 2 of the Finals by leveling the series. Interestingly, the NBA Finals played a huge role in Jokic’s reduced salary. Moreover, this isn’t the case only for the 2x MVP, but for every NBA player.

Jokic takes home only 51% of his income because of Michael Jordan and other taxes

ADVERTISEMENT

Article continues below this ad

The NBA stars are some of the highest paid athletes across the globe. Despite bagging the huge dollar, these sports stars don’t take them home entirely because of the tax burden. In the case of Nikola Jokic, he will lose $22.67 million due to taxes on his $46.9 million annual income when his new 5 year/$272 million contract kicks in next season.

Nikola Jokic's income after taxes 🥴

$46.9M: Salary

–

$17.36M: Federal Tax

$2.06M: Colorado Tax

$1.41M: Agent Fee

$1.4M: Jock Tax

$436k: FICA

=

$24.23M: Net Income pic.twitter.com/DqEQfoOZec— Andrew Petcash (@AndrewPetcash) June 5, 2023

NBA players are liable to pay taxes from the annual salary on various grounds: Federal Tax, Colorado Tax, Agent Fee, Jock Tax and FICA. Interestingly, Michael Jordan played a pivotal role in the introduction of ‘Jock Tax’ for the hoopers.

Trending

Bronny in Deep Waters as $800,000 Suffering Forces LeBron James’ Son to End College Career With Major Declining Numbers

April 27, 2024 01:45 PM EDT

Bronny’s Suffering Doesn’t Affect Brother Bryce as LeBron James’ Younger Son Sees Stability Financially

April 28, 2024 02:24 PM EDT

LeBron James Raids Wife Savannah’s Wardrobe For Game 4 Win, Leaving 35YO Stylist “Weak”

April 28, 2024 07:16 PM EDT

Nike EYBL: Emotional Kiyan Anthony Talks About Father Carmelo While Bryce James Hails 17YO Brodie

April 28, 2024 04:08 PM EDT

“That Was Too Much”: LeBron Gave Bryce James a Tough Pill to Swallow 1 Week Before His Nike EYBL Game

April 29, 2024 02:32 PM EDT

Get instantly notified of the hottest NBA stories via Google! Click on Follow Us and Tap the Blue Star.

Follow Us

3x NBA Champion Gives Nikola Jokic the Hard Truth Over a Michael Jordan and Larry Bird Pickup Game: “Don’t Think He Can Play”

Except for a few states, every state in the US has implemented the collection of ‘Jock Tax’ after the iconic 1991 Finals where Jordan won his first of six NBA titles against the Los Angeles Lakers in California.

ADVERTISEMENT

Article continues below this ad

MJ’s dominance led to the introduction of Jock tax

In simple terms, every NBA player owes resident tax for earning a game fee for the games played outside their home state. This tax came into existence because of a revenge story after the 1991 Finals. When the Chicago Bulls dominated Magic Johnson’s Lakers in the Finals and clinched the title, the city of Los Angeles slapped MJ with taxes for the days spent in LA partying. In response, Illinois retaliated with ‘Michael Jordan’s Revenge’ tax and slapped it on every player from California playing in Chicago.

Watch This Story – Savage Old Man Tom Brady Trolls Michael Jordan for ‘Soft Hands’ in a Round of Golf

ADVERTISEMENT

Article continues below this ad

Things escalated from there and today, almost every state issues jock tax on visiting athletes. Not just the players, but the coaches, trainers, doctors and anyone who earned extra income in another state has to pay the jock tax.

What do you make of the heightened tax burden on the players? Let us know your thoughts in the comments below.

Edited by:

Pragya Vashisth