Set to Pay $20,350,000 in US Federal Taxes, Lionel Messi’s Post-Retirement Life Compared to Michael Jordan and David Beckham

Follow Us

via Imago

Credits: IMAGO

All thanks to his magic on the soccer ground, Lionel Messi has earned legendary status in sports. His accolades and records are a testament to that. His skillful display has left an indelible mark. However, as the Argentine is approaching the twilight of his career, he will potentially play club soccer for the last time with MLS club Inter Miami.

But do you know the Inter Miami deal will open impressive off-field endeavors for Messi in the future? And that’s what Miami’s co-owner reiterated recently. Moreover, Jorge Mas compared Messi’s post-retirement life to that of David Beckham and Michael Jordan.

Future avenues await soccer legend Lionel Messi

ADVERTISEMENT

Article continues below this ad

The Argentine was in no mood to create drama around his transfer this summer. When he realized FC Barcelona’s move was nearly impossible, he decided to join Inter Miami. But a question arose after his decision: why he snubbed a billion-dollar Saudi deal? As the days went by, reports revealed the details of the contract.

Apart from salary and bonuses, Messi will also earn from other variables. The Argentine will get a share from the profits of MLS season passes Apple TV will sell after his arrival. He will get a share from the profits of Adidas on the jerseys of the Argentine sold. Moreover, Joe Pompliano (sports finances expert) believes the former PSG superstar will get to buy stakes in Inter Miami at a discounted price.

Trending

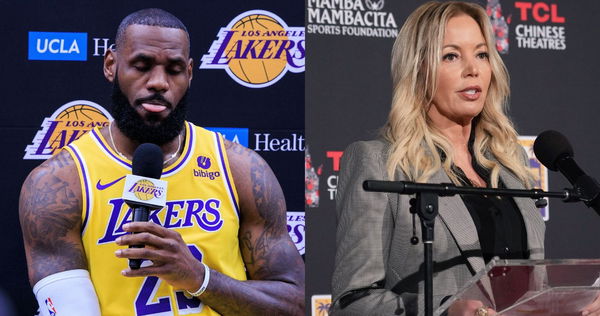

Lakers News: Jeanie Buss’ Probable Locker Room Solution Will Please LeBron James & Trigger Box Office Drama

May 12, 2024 03:00 AM EDT

LeBron James’ Family Wants Him to End Career But Ex-Lakers Star Uses 16YO Bryce James To Make Tempting Offer

May 12, 2024 05:17 AM EDT

Lakers News: JJ Redick Advised To Find Hope In Steph Curry’s Favorite Person As Jeanie Buss Interest Grows

May 12, 2024 06:18 AM EDT

Shaunie Wouldn’t Have Married Keion Henderson After Shaquille O’Neal Divorce if Not for This Reason

May 12, 2024 01:46 PM EDT

Mother of 5, Dwyane Wade’s Wife Gabrielle Admits Changing Herself Due to 3 Things

May 13, 2024 12:30 PM EDT

Get instantly notified of the hottest NBA stories via Google! Click on Follow Us and Tap the Blue Star.

Follow Us

🗣️ Inter Miami managing owner Jorge Mas tells El Pais talks with Lionel Messi started in 2019 and predicts his arrival will “turn the MLS into one of the two or three biggest leagues in the world.” 🇦🇷 pic.twitter.com/AmMe0VvnS9

— Ben Jacobs (@JacobsBen) July 2, 2023

And that’s what The Herons’ co-owner Jorge Mas recently suggested. While speaking to Spanish outlet El Pais, Mas compared the post-retirement life of Messi to that of David Beckham and NBA great Michael Jordan. He indicated that Messi would enter sports team ownership like Beckham and Jordan.

Mas said, “I imagine a life after soccer for Messi very similar to that of David [Beckham] or Michael Jordan. He will be able to continue his work in a market that will not stop growing. He will have opportunities that are not available elsewhere.” The seven-time Ballon d’Or winner will earn $55 million in salaries and bonuses, per Jorge Mas. But of this $55 million, how much will go into taxes?

A tax breakup of Messi’s salary:

$55 million isn’t only the salary of Messi, as it includes a signing bonus and equity. However, like other nations, the Argentine is liable for taxes in the US. According to another American financial expert, Andrew Petcash, $20.35 million of Messi’s income will go to Federal Tax.

ADVERTISEMENT

Article continues below this ad

Lionel Messi is set to be the highest-paid athlete on US soil.

And his taxes will be steep: 👀

$55M: Salary

–

$20.35M: Federal Tax

$0: Florida Tax

$0: Agent Fee

$1.64M: Jock Tax

$1.29M: FICA/Medicare

=

$31.7M: Net Income pic.twitter.com/OAROpZtzl7— Andrew Petcash (@AndrewPetcash) June 20, 2023

Apart from Federal Taxes, Messi will pay $1.64 million Jock Tax and $1.29 million FICA/Medicare Tax. However, as he will be in Florida, which doesn’t charge any taxes on foreigners’ income, the former Barcelona talisman is liable to $0 Florida Tax. Moreover, he will pay $0 on Agent Fees as his father is his agent. It brings Messi’s net earnings to $31.7 million.

ADVERTISEMENT

Article continues below this ad

WATCH THIS STORY: American Athletes With Ownership in Soccer Teams

Do you think the Inter Miami deal has the potential of earning more than what Al Hilal offered?

Edited by:

Abhishek Kumar